-

A diagonal spread is an options strategy that involves buying (selling) a call (put) option at one strike price and one expiration and selling (buying) a second call (put) at a different strike price and expiration.

-

Diagonal spreads allow traders to construct a trade that minimizes the effects of time, while also taking a bullish or bearish position.

- It is called a “diagonal” spread because it combines features of a horizontal (calendar) spread and a vertical spread.

Types of Diagonal Spreads

Because there are two factors for each option that are different, namely strike price and expiration date, there are many different types of diagonal spreads. They can be bullish or bearish, long or short, and utilize either puts or calls.

Most diagonal spreads are long spreads and the only requirement is that the holder buys the option with the longer expiration date and sells the option with the shorter expiration date. This is true for both call diagonals and put diagonals alike.

What decides whether either a long or short strategy is bullish or bearish is the combination of strike prices. The table below outlines the possibilities:

In this article, we will use a call diagonal spread to explain the concept, but a diagonal spread can be used with puts as well.

Diagonal spreads are typically set up like vertical debit spreads, where the long option has a longer duration than the short option. This strategy is typically used to take directional assumptions on products in a defined risk way, while still reducing cost basis aggressively by selling a near-term option against the asset in the trade – the further-dated long option.

Diagonal Spread Strategy: How it Works

Diagonal spreads are like vertical spreads in the sense that you want them to move in-the-money (ITM). A long diagonal spread is nothing more than a vertical spread with a longer-term long option. With this in mind, max profit can be more than the width of the diagonal spread, since the short option will expire prior to the long option.

The long option will hold extrinsic value as the short option expires, which is how we think of the trade – like a vertical spread with a potential extrinsic value boost in the long option.

If a long diagonal spread is showing a loss, that means the spread is moving out-of-the-money (OTM) and both the long and short options are losing value. Since there is a time difference between the long and short option, there are plenty of defensive tactics we can deploy to continue to hedge and reduce the cost of the long option that remains. This may involve rolling the short option out in time closer to the long option’s expiration, rolling the short option closer to the long option vertically in the same expiration, or a combination of both.

Diagonal Bull Call Spread Construction

-

Buy 1 Long-Term ITM Call

-

Sell 1 Near-Term OTM Call

Limited Upside Profit

The ideal situation for the diagonal bull call spread buyer is when the underlying stock price remains unchanged and only goes up and beyond the strike price of the call sold when the long term call expires. In this scenario, as soon as the near month call expires worthless, the options trader can write another call and repeat this process every month until expiration of the longer term call to reduce the cost of the trade. It may even be possible at some point in time to own the long term call “for free”.

Under this ideal situation, maximum profit for the diagonal bull call spread is obtained and is equal to all the premiums collected for writing the near-month calls plus the difference in strike price of the two call options minus the initial debit taken to put on the trade.

Limited Downside Risk

The maximum possible loss for the diagonal bull call spread is limited to the initial debit taken to put on the spread. This happens when the stock price goes down and stays down until expiration of the longer term call.

Long put and call diagonal spreads are defined risk in nature, where the max loss potential is the debit paid up front if the long option expires worthless. Losses prior to expiration can be seen if the stock moves in the wrong direction and the spread moves further OTM, where both options lose extrinsic value.

The short option in a diagonal spread works to hedge against the cost of the long option, and also against unfavorable moves, but the short option is only worth a fraction of the long option, so the hedge is only temporary.

If the short option has lost most of its value or has expired, another short option can be sold against the long to continue reducing cost basis. Just be mindful of the width of the spread, and to ensure that the net debit still does not exceed the width of the spread if the short strike is moved closer to the long strike.

The spread can be sold to close prior to expiration for less than max loss if the trader’s assumption has changed, or they do not believe the spread will move back ITM prior to the expiration of the long option.

Example

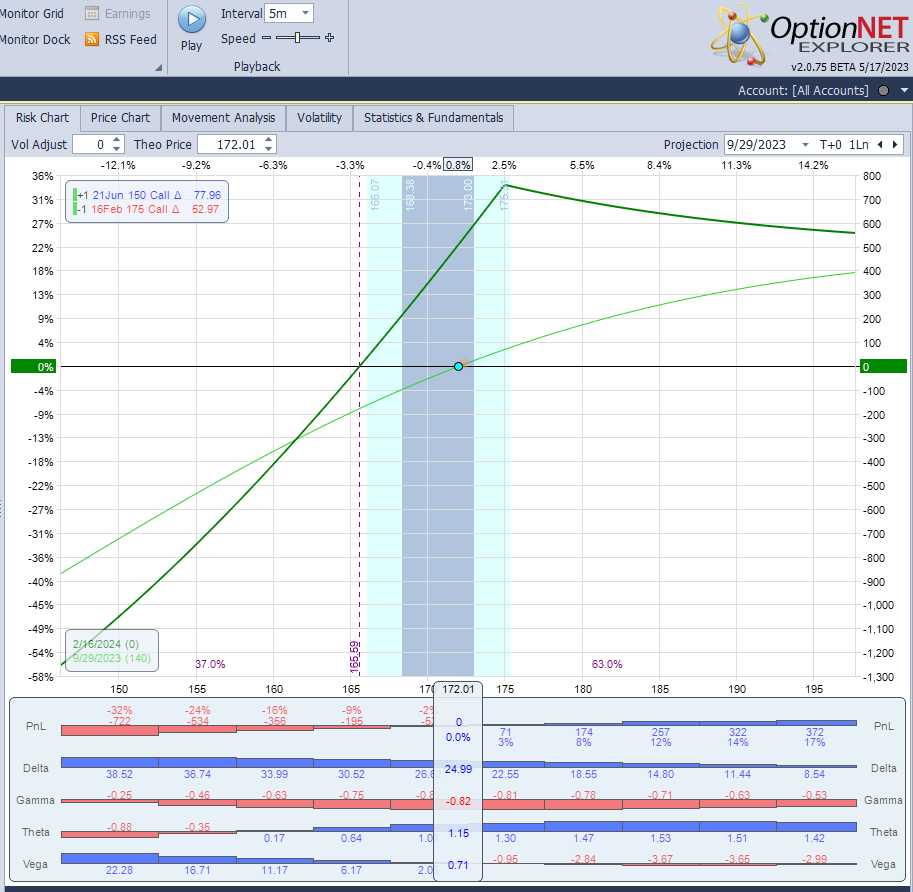

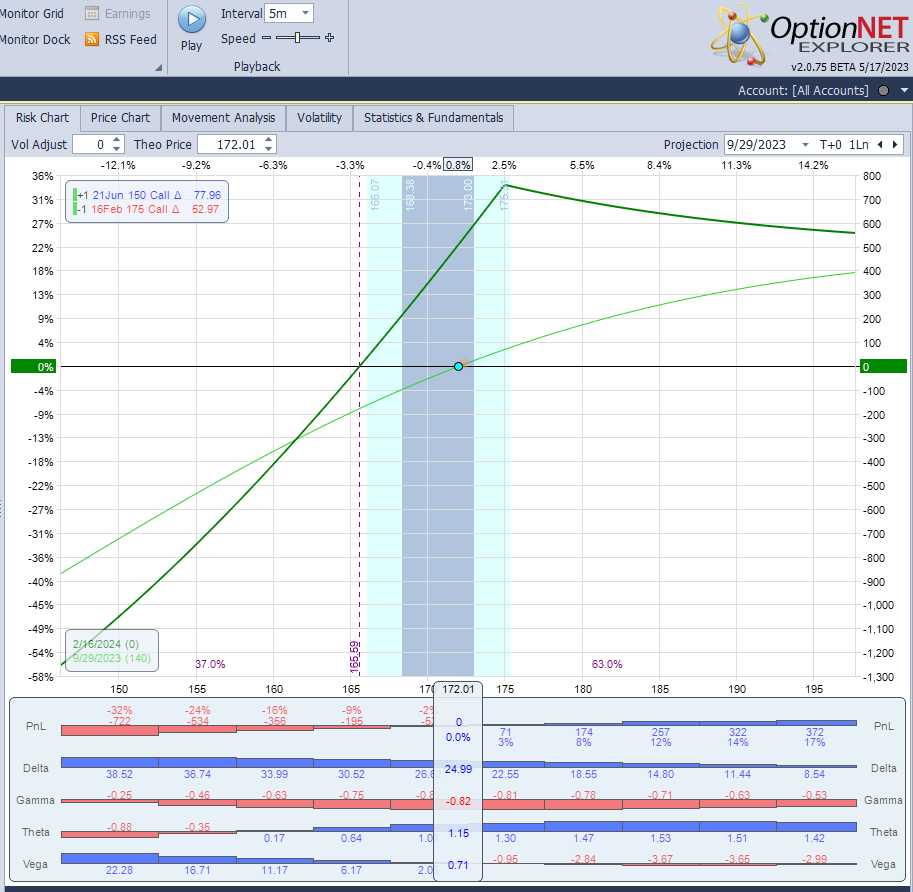

An options trader believes that AAPL stock trading at $172 is going to rise gradually for the next four months. He enters a diagonal bull call spread by buying a June 2024 150 call and writing a Feb 2024 175 call for. The net investment required to put on the spread is a debit of $2200.

This is how the P/L chart looks like:

The stock price of AAPL goes up to $175 in the next 4 months. As each near-month call expires, the options trader writes another call of the same or slightly higher strike.

Time decay impact on a Diagonal Spread

Time decay, or theta, will positively impact the front-month short call option and negatively impact the back-month long call option of a call diagonal spread. Typically, the goal is for the short call option to expire out-of-the-money. If the stock price is below the short call at expiration, the contract will expire worthless. The passage of time will help reduce the full value of the short call option.

The time decay impact on the back-month option is not as significant early in the trade, but the theta value will increase rapidly as the second expiration approaches. This may influence the decision related to exiting the position.

Adjusting a Diagonal Spread

Call diagonal spreads can be adjusted during the trade to increase credit. If the underlying stock price declines rapidly before the first expiration date, the short call option can be purchased and sold at a lower strike closer to the stock price. This will collect more premium, but the risk increases to the adjusted spread width between the strikes of the near-term expiration contract and long-term expiration contract if the stock reverses. If the short call option expires out-of-the-money, and the investor does not wish to close the long call, a new position may be created by selling another short call option.

The ability to sell a second call contract after the near-term contract expires or is closed is a key component of the call diagonal spread. The spread between the short and long call options would need to be at least the same width to avoid adding risk. Selling a new call option will collect more credit, and may even lead to a risk-free trade with unlimited upside potential if the net credit received is more than the width of the spread between the options.

Assignment risk

One of the frequent questions is: what happens if the stock rises and the short calls become ITM? Is there an assignment risk?

The answer is that assignment risk becomes real only when there is very little time value in the short options. This will happen only if they become deep ITM and we get close to expiration. When it happens, you might roll the short options or close the trade. In any case, this is not an issue because even if we are assigned short stock, the short stock position is hedged by the long calls.

In case of the upcoming dividend, there is some assignment risk only if the remaining time value of the short calls is less than the dividend value.

Of course there is no assignment risk if the calls are OTM or around ATM.

Related articles:

-

Options Theta Explained: Price Sensitivity To Time

-

Calendar Spread Option Strategy: The Ultimate Guide

-

Leverage With A Poor Man’s Covered Call

-

Stock Option Strike (Exercise) Price Explained

Diagonal spreads are like vertical spreads in the sense that you want them to move in-the-money (ITM). A long diagonal spread is nothing more than a vertical spread with a longer-term long option. With this in mind, max profit can be more than the width of the diagonal spread, since the short option will expire prior to the long option.

The long option will hold extrinsic value as the short option expires, which is how we think of the trade – like a vertical spread with a potential extrinsic value boost in the long option.

If a long diagonal spread is showing a loss, that means the spread is moving out-of-the-money (OTM) and both the long and short options are losing value. Since there is a time difference between the long and short option, there are plenty of defensive tactics we can deploy to continue to hedge and reduce the cost of the long option that remains. This may involve rolling the short option out in time closer to the long option’s expiration, rolling the short option closer to the long option vertically in the same expiration, or a combination of both.

Diagonal Bull Call Spread Construction

- Buy 1 Long-Term ITM Call

- Sell 1 Near-Term OTM Call

Limited Upside Profit

The ideal situation for the diagonal bull call spread buyer is when the underlying stock price remains unchanged and only goes up and beyond the strike price of the call sold when the long term call expires. In this scenario, as soon as the near month call expires worthless, the options trader can write another call and repeat this process every month until expiration of the longer term call to reduce the cost of the trade. It may even be possible at some point in time to own the long term call “for free”.

Under this ideal situation, maximum profit for the diagonal bull call spread is obtained and is equal to all the premiums collected for writing the near-month calls plus the difference in strike price of the two call options minus the initial debit taken to put on the trade.

Limited Downside Risk

The maximum possible loss for the diagonal bull call spread is limited to the initial debit taken to put on the spread. This happens when the stock price goes down and stays down until expiration of the longer term call.

Long put and call diagonal spreads are defined risk in nature, where the max loss potential is the debit paid up front if the long option expires worthless. Losses prior to expiration can be seen if the stock moves in the wrong direction and the spread moves further OTM, where both options lose extrinsic value.

The short option in a diagonal spread works to hedge against the cost of the long option, and also against unfavorable moves, but the short option is only worth a fraction of the long option, so the hedge is only temporary.

If the short option has lost most of its value or has expired, another short option can be sold against the long to continue reducing cost basis. Just be mindful of the width of the spread, and to ensure that the net debit still does not exceed the width of the spread if the short strike is moved closer to the long strike.

The spread can be sold to close prior to expiration for less than max loss if the trader’s assumption has changed, or they do not believe the spread will move back ITM prior to the expiration of the long option.

Example

An options trader believes that AAPL stock trading at $172 is going to rise gradually for the next four months. He enters a diagonal bull call spread by buying a June 2024 150 call and writing a Feb 2024 175 call for. The net investment required to put on the spread is a debit of $2200.

This is how the P/L chart looks like:

The stock price of AAPL goes up to $175 in the next 4 months. As each near-month call expires, the options trader writes another call of the same or slightly higher strike.

Time decay impact on a Diagonal Spread

Time decay, or theta, will positively impact the front-month short call option and negatively impact the back-month long call option of a call diagonal spread. Typically, the goal is for the short call option to expire out-of-the-money. If the stock price is below the short call at expiration, the contract will expire worthless. The passage of time will help reduce the full value of the short call option.

The time decay impact on the back-month option is not as significant early in the trade, but the theta value will increase rapidly as the second expiration approaches. This may influence the decision related to exiting the position.

Adjusting a Diagonal Spread

Call diagonal spreads can be adjusted during the trade to increase credit. If the underlying stock price declines rapidly before the first expiration date, the short call option can be purchased and sold at a lower strike closer to the stock price. This will collect more premium, but the risk increases to the adjusted spread width between the strikes of the near-term expiration contract and long-term expiration contract if the stock reverses. If the short call option expires out-of-the-money, and the investor does not wish to close the long call, a new position may be created by selling another short call option.

The ability to sell a second call contract after the near-term contract expires or is closed is a key component of the call diagonal spread. The spread between the short and long call options would need to be at least the same width to avoid adding risk. Selling a new call option will collect more credit, and may even lead to a risk-free trade with unlimited upside potential if the net credit received is more than the width of the spread between the options.

Assignment risk

One of the frequent questions is: what happens if the stock rises and the short calls become ITM? Is there an assignment risk?

The answer is that assignment risk becomes real only when there is very little time value in the short options. This will happen only if they become deep ITM and we get close to expiration. When it happens, you might roll the short options or close the trade. In any case, this is not an issue because even if we are assigned short stock, the short stock position is hedged by the long calls.

In case of the upcoming dividend, there is some assignment risk only if the remaining time value of the short calls is less than the dividend value.

Of course there is no assignment risk if the calls are OTM or around ATM.

Related articles:

- Options Theta Explained: Price Sensitivity To Time

- Calendar Spread Option Strategy: The Ultimate Guide

- Leverage With A Poor Man’s Covered Call

-

Stock Option Strike (Exercise) Price Explained